Here’s a rewritten version with a more provocative tone:

“Shake the Foundations of Africa’s Energy System with R160 Million injection

In a bold move that could shake the very foundations of Africa’s energy sector, Solarise Africa has landed a whopping R160 million investment from Mergence Investment Managers. This behemoth injection will turbocharge the company’s push to install and expand solar energy systems for commercial and industrial clients across the continent, driving a new era of sustainability and economic growth.

Solarise Africa, the brainchild of CEO Jan Albert Valk, has a single-minded mission to transform the way African businesses source their energy. And this investment is the proof that Mergence Investment Managers is backing this vision with its own weight and substance.

According to Valk, the injection of capital will allow Solarise Africa to “accelerate its growth” and “reach more businesses in need of reliable, clean energy solutions.” In a bold statement, he declares: “The C&I solar market in South Africa continues to thrive, and businesses will keep investing in renewable energy solutions until the grid is fixed.”

Valk’s comments are nothing short of revolutionary, casting a critical eye on the reliability of Africa’s energy infrastructure and daring to predict a future where businesses will opt for clean energy over the fragile grid.

But Mosa Molebatsi, senior investment associate at Mergence Investment Managers, is already convinced. “This investment is a testament to the growing confidence in renewable energy in South Africa and our role in this transformative journey,” he says.

And to add some more firepower to Solarise Africa’s arsenal, PSG Capital and Viruni Capital Partners have weighed in to advise on the acquisition. For Khaya Hlophe-Kunene, director at PSG Capital, this is all about supporting innovative energy solutions and making a difference on the African continent.

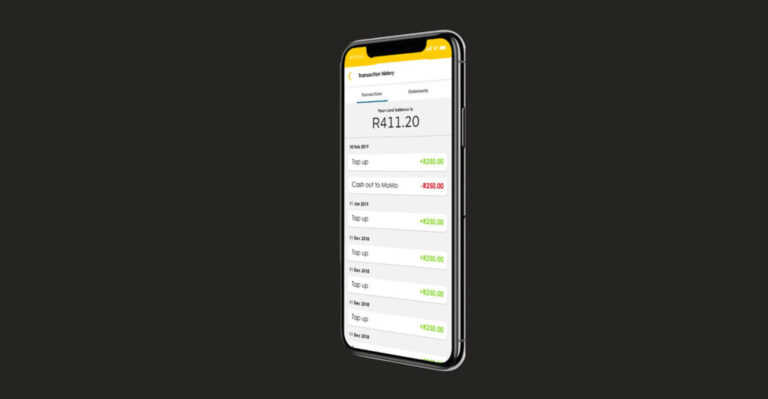

Get ready for the biggest shake-up in the sports radio scene: MTN and Omniaudio have joined forces to bring you a zero-rated sports radio platform that’s free from the shackles of data costs.

Get ready for the biggest shake-up in the sports radio scene: MTN and Omniaudio have joined forces to bring you a zero-rated sports radio platform that’s free from the shackles of data costs.