Google parent Alphabet plans to spend around US$75-billion in capital expenditure in 2025, most of it on AI and cloud infrastructure. This scale of this investment has sparked debate, especially when compared to leaner approaches by competitors like China’s DeepSeek, which has achieved near-peer performance at a fraction of the cost.

However, in the context of Alphabet’s history, this level of spending is not out of character. From early bets on Android and Google Maps to building custom data centre infrastructure, Alphabet/Google has consistently committed resources to long-term foundational technologies. AI is simply the next platform shift, and Alphabet is aiming to shape it from the ground up. While returns may take years to fully materialise, history suggests that they could be meaningful.

A leaner, smarter AI race?

DeepSeek has drawn global attention by delivering a viable, competitive AI model that reportedly cost just under $6-million — pocket change for a company like Alphabet. Alongside DeepSeek, Europe’s Mistral is proving that smart architecture, training efficiency and lean data strategies can deliver cutting-edge results at a fraction of the typical cost.

On paper, the contrast is stark: DeepSeek launches AI models that compete with the best technology the tech giants have to offer at a fraction of the cost. Mistral’s compact, efficient models are already in commercial use, and Meta is pushing ahead with Llama 3, focused on lowering cost-per-token ratios (the cost of each individual unit of text processed). These players raise a valid question: is Alphabet overspending?

Alphabet’s AI investment is not just about building better models. Rather, it is about building a vertically integrated AI ecosystem spanning custom chips, model development, product integration and global distribution. In short, it reflects a strategic ambition to embed AI across nearly every layer of its operations.

This includes a shift in Google Search with generative AI at its core, and the enhancement of YouTube through AI-powered summarisation and content discovery tools. Google Ads, still the company’s primary revenue generator, is being supercharged through AI-driven automation and personalisation. AI is also being integrated into Workspace, Android and the Pixel device ecosystem. In parallel, Google Cloud is delivering advanced AI infrastructure to enterprise clients, with Gemini positioned as a key competitive differentiator.

These initiatives are expensive, and while Alphabet is perceived to have been late to the generative AI race, its strategy is deliberate. The company is not just reacting to market trends; it is aiming to control the infrastructure and delivery mechanisms of the AI-powered internet.

Lean players

Lean players like DeepSeek and Mistral will remain relevant – particularly for start-ups, developers and government-backed efforts seeking open-source flexibility and cost control. If their pace of innovation continues, they could commoditise parts of the model stack, much like Linux reshaped the software world.

As the cost of AI continues to decrease, it is likely that the growing demand for AI across various use cases could drive the expansion of Alphabet’s services. By building a comprehensive ecosystem that commercialises AI, Alphabet will be well-positioned to capitalise on this rising demand and support the platform’s growth.

Read: Google unleashes big Android redesign

This is not the first time Alphabet (or Google) has faced criticism for spending heavily on what seemed like non-core projects. In the late 2000s, the company’s forays into self-driving cars, a mobile operating system and digital mapping raised concerns. At the time, investors questioned whether the company had lost focus. A decade later, those same projects have become central to Alphabet’s dominance.

The acquisition of Android in 2005 positioned Google at the forefront of the mobile revolution, leading to its dominance in the global smartphone market. YouTube, purchased in 2006 for $1.65-billion, now generates over $30-billion in revenue annually and has over two billion users. Google Maps, once an experiment, became a core utility integrated across Alphabet’s products and monetised through advertising and services. These initiatives were not obviously profitable at the outset, but they reveal a consistent strategy: invest early in transformative technologies, even before their commercial value is fully apparent.

Read: Is this the end of Google Search as we know it?

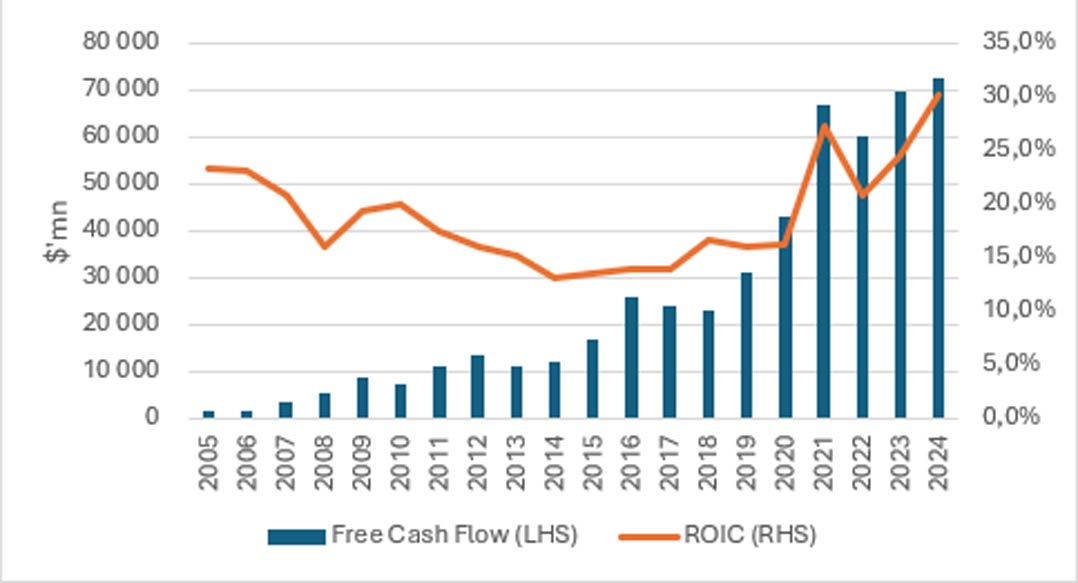

This approach is enabled by Alphabet’s financial strength. The company has consistently generated on average more than $40-billion in free cash flow in the last decade, giving it the ability to fund major initiatives without straining its balance sheet. Its return on invested capital (ROIC), which has averaged 19.3% since 2003, comfortably exceeds its cost of capital – signalling disciplined capital allocation and strong value creation. Alphabet is not only capable of investing at scale but has also demonstrated a clear ability to convert early-stage bets into foundational business pillars.

Betting big on the future

Alphabet’s $75-billion capex plan is not reckless. It is a continuation of a long-term strategy that has historically delivered significant value. While challengers like DeepSeek and Mistral optimise for cost and speed, Alphabet is building the infrastructure and integration needed to shape the next version of the internet. The company’s track record of turning early investments into enduring products and services suggests that today’s AI spend may look prescient in hindsight. Alphabet is not just investing in models – it is investing in future relevance.

Get breaking news from TechCentral on WhatsApp. Sign up here.

- The author, Nadine Chetty-Khan, is research analyst at Private Clients by Old Mutual Wealth